Find out as much as you can before committing and ask questions if you need to. Your partner should use encrypted systems, follow the strictest data security practices, and comply with all relevant data protection laws (like GDPR in Europe or the CCPA in California). Remote ticks all these boxes, and is in line with GDPR, SOC 2, and ISO27001 standards. By outsourcing your payroll, you can streamline your operations, reduce administrative burden, and gain access to expertise. It is important to note that not all PEOs are CPEOs, and businesses should research carefully any PEO they are considering working with to ensure that it meets their needs and expectations. HRO and ASO may be more suitable for businesses that only need to outsource certain HR tasks or want more control over their HR functions.

What services does a PEO provide?

Remote can do all the heavy lifting for you, giving you peace of mind and allowing you to focus your time, money, and resources elsewhere. Keeping everyone in the loop helps manage expectations, ease any worries or uncertainties, and ensure your team feels informed at every step. To make your life significantly easier, you’ll want to use a payroll platform that can integrate seamlessly with your existing HR tech stack.

- ASO providers do not assume co-employment responsibilities and do not become the employer of record for tax and compliance purposes.

- If a provider handles payroll data for employees in the European Union (EU), they have to meet General Data Protection Regulation (GDPR) standards.

- The dashboard had a handful of reports and optional action items but didn’t feel cluttered or overwhelming.

- This is especially true if you’re partnering with providers in unfamiliar markets, where there are significant cultural and language differences.

- We then scored these contenders across 34 metrics in five categories weighted to favor features that small business owners find valuable in a payroll provider.

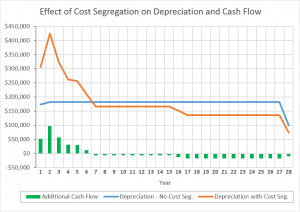

Cost savings

Follow this guide to learn more about payroll outsourcing and how it can benefit your business. In my experience, setting up automations was as intuitive as possible, given the large ripple effect each automation produces. I had to first set up people groups within the platform, including their permission levels and other specifications.

Better experiences for scaling teams

Other components are training and development and performance measurement. Justworks’ site puts the features and prices of its PEO services for small businesses front and center. That way, small business owners can estimate for themselves which HR and payroll features they’ll receive and how much it will cost—without having to enter their business and contact information.

A PEO is a type of company that provides HR-related services to businesses, such as payroll, benefits and risk management. However, only the PEO Basic and PEO Plus plans provide consultations with HR professionals for planning and implementing your company’s HR and payroll processes. PEO Basic costs $59 per employee per month, and PEO Plus is priced at $109 per employee per month. The TriNet PEO platform makes risk management and compliance a part of a business’s employee management from recruitment to offboarding. Its risk management functions cover claims prevention and mitigation, including pre-negotiated fees and caps with external counsel.

We also evaluated each PEO service on its own merits, taking into account factors such as payroll services, employee benefits, HR management features and compliance assistance. We also considered whether the PEO offers any additional features that would be beneficial for small businesses such as payroll funding or an employee assistance program. Also offered in its PEO services are payroll and tax administration, benefits management, multiple employer 401(k) retirement plans and recruiting and talent management. AlphaStaff’s services for startups are designed to help new businesses avoid the most common startup mistakes.

What are your payroll outsourcing options?

This highly agile team, which is ready to partner with you, includes experts in people insights, change management and communications, how to account for partial disposals subsidiary to associate process optimization and project support. On top of managed payroll, you can add value by also choosing to outsource benefits administration, talent, time, and attendance management. With an in-house payroll department, you have to pay your internal team’s salaries, benefits, and payroll taxes. You must also cover training to help your team keep up with the latest tools and trends. When you’re dealing with payroll across different countries, rules can vary massively, including regulations tied to wages, overtime, taxes, social security, and data protection.

Most payroll services also include benefits administration, so you can use the platform to set up paid time off, retirement plans, insurance and other benefits for employees and integrate benefits with payroll. Rippling offers all the tools you’d expect in a small business payroll software, including automated payroll, tax filing support, direct deposit payments and reporting. TriNet offers three plans ranging from $8 per employee per month to $33 per user per month when billed monthly. However, unlike many competitors on this list, only the most expensive plan offers payroll features. To access payroll features in the first two tiers, you have to first purchase the core plan and then pay $6 per employee per month more to access the payroll add-on. When I contacted customer support, I was told that this payroll add-on is typically only sold as an add-on and not as a standalone product.

Ideally, there will be an API option, too, so that you can customize your integrations. “Our CSM — in fact, the whole Remote team — are clear when they offer guidance. I’m not a native English speaker, and the style of communication is so pleasant. I don’t feel alone in the process.” Since you’re trusting another company with personal and financial boeing suppliers data, you need to be sure that it is compliant and able to protect against data theft. The Forbes Advisor Small Business team is committed to providing unbiased rankings and information with full editorial independence. We use product data, strategic methodologies and expert insights to inform all of our content to guide you in making the best decisions for your business journey. Everything included in our “Plus” package and automated time-tracking with Time and Attendance.

But they also offer extensive support and administrative services to help teams minimize the amount of work required internally to keep enrolled agent vs cpa HR functions running. Payroll co-sourcing is a type of payroll outsourcing in which a third-party payroll provider and employees of the business share payroll processing responsibilities. That way, a small business is getting the best of both worlds, allowing them to selectively decide what aspects of payroll they do themselves and which they’d rather have done by the experts.